Banks to Strengthen Transfer Limits from June 1: Who Will Be Affected by the New Rules.

Banks Have Set Limits on Transfers for Clients

In December 2024, 44 banks together with several financial companies signed a memorandum on transparency in the banking services market. The aim of this step was to prevent financial crimes and shadow operations. The main discussion of the memorandum focuses on categorizing clients by risk levels and setting limits for transfers.

The Chairman of the NBU, Andriy Pyshnyy, stressed: 'The memorandum does not strengthen financial monitoring and client assessment in banks and does not impose additional restrictions on clients.'

From February 1, 2025, clients with low and medium risk will have limits of 150 thousand UAH per month for outgoing transfers. Meanwhile, for high-risk clients, the limit will be 50 thousand UAH per month. From April 1, 2025, regulatory restrictions will not be extended, transferring greater responsibility to the banks.

Strengthening Restrictions

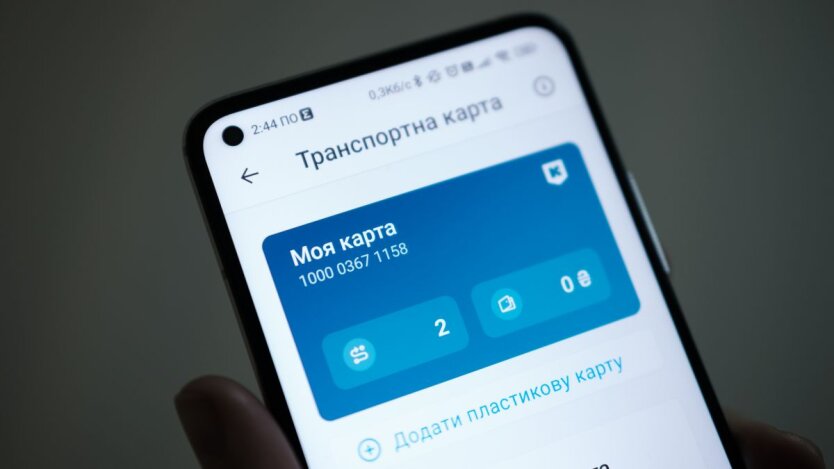

From June 1, 2025, restrictions will be strengthened: the limit for clients with medium and low risk will decrease to 100 thousand UAH per month. For high-risk clients, the limit will remain unchanged at 50 thousand UAH. These restrictions will affect all types of transfers: from card to card, as well as between accounts.

It is worth noting that clients with verified incomes, receiving salaries on bank cards or engaging in charitable activities, will not be subject to restrictions. Additionally, personal transfers between accounts within the same bank will not be restricted.

Limits on the Number of Accounts

Participants of the memorandum set out that clients without verified sources of income can have no more than three accounts in one currency. However, these restrictions do not apply to deposit, credit accounts, and accounts for receiving government aid.

This innovation is aimed at protecting against potential financial crimes and ensuring transparency in the banking system. Despite some restrictions, they will help to detect and prevent irregular financial operations in the future.

Read also

- Ukraine's accession to the EU at the expense of the aggressor: proposal by the NBU head

- Ukraine will abandon 50 kopecks: what will replace the coin

- The budget will receive a record amount from the NBU: the figure has been announced