The National Bank wants to change the procedure for opening and closing accounts.

The National Bank proposes banks to change the procedure for opening and closing accounts

The National Bank of Ukraine has proposed to banks that provide payment services for account servicing to update the procedure for opening and closing user accounts. This was reported by 'Hvylya' referring to the NBU's statement.

According to the National Bank's proposal, it will not be mandatory to submit copies of documents on accounting registration by the controlling authority of separate subdivisions of non-resident legal entities and their representatives. This information will be contained in the Unified State Register.

Furthermore, the NBU proposes to establish the procedure for opening a correspondent account at the European Investment Bank and opening accounts for residents of Ukraine in the national currency by financial institutions.

The National Bank also plans to regulate the issues of closing accounts of separate subdivisions of non-resident legal entities in case of their liquidation, as well as transferring funds after the withdrawal of the payment service provider's license, cessation of services, or bankruptcy.

The draft resolution of the NBU board outlines all the necessary norms. Proposals and comments can be sent to the National Bank by February 19, 2025.

We remind you that the NBU also forecasts tariffs for gas and heating.

Read also

- Real estate in southern Ukraine: what is the cost of renting or buying an apartment

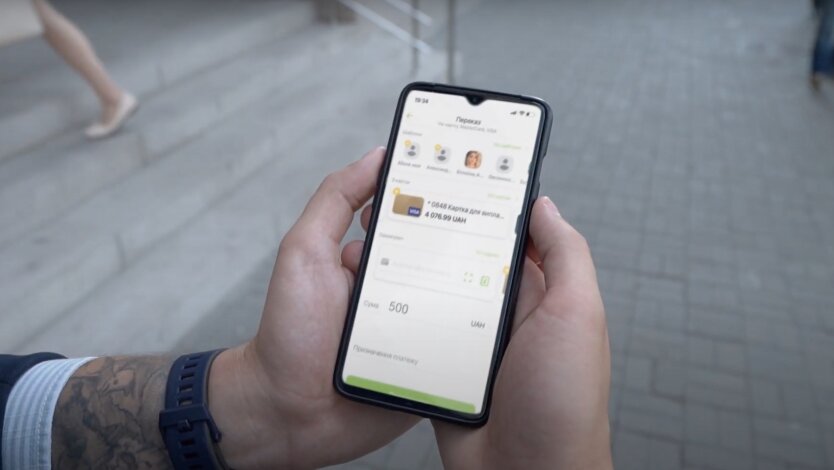

- New Opportunity for Entrepreneurs: PrivatBank Simplified Key Procedure

- Transition from dollar to euro: NBU names timelines, and IMF - conditions

- Not only tax: who else will gain access to the banking secrets of Ukrainians

- Blood group linked to early stroke risk: study results

- Zelensky confirmed the death of the commander of the 110th Mechanized Brigade, Zakharievich, as a result of a missile strike